Get the free army high dollar value sheet da 4986

Show details

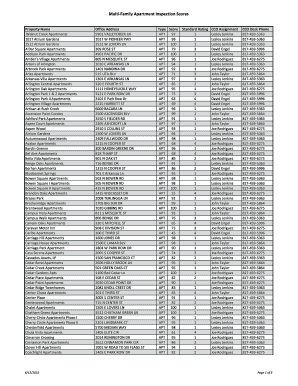

Post one copy of DA Form 4986 (High Dollar Item Sheet) on the inside of the door and turn one copy ... A high dollar item is one with a value of $50.00 or ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign da 4986 form

Edit your da form 4986 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your army high value item sheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit high dollar value sheet online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit high dollar value sheet army form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out army high dollar value sheet form

How to fill out high dollar value sheet:

01

Start by gathering all the necessary information required for the high dollar value sheet. This may include details such as the item's description, quantity, value, and any additional relevant information.

02

Ensure that you have access to the appropriate form or template for the high dollar value sheet. This could be provided by your organization or may be available online.

03

Begin by entering the date on the sheet. This will help in organizing and tracking the information.

04

Fill in the item's description accurately and concisely. This could include a brief overview of the item, its specifications, or any other necessary information.

05

Enter the quantity or number of units for each item being documented on the high dollar value sheet. This will help establish the total value of the items listed.

06

Indicate the value or cost of each item. This should reflect the current market value or the price at which the item was acquired.

07

Include any additional information that may be required, such as the date of acquisition, the purpose of the item, or any relevant notes.

08

Review the completed high dollar value sheet for accuracy and completeness. Make sure all necessary fields are filled out properly.

09

Submit the high dollar value sheet to the appropriate individual or department as per your organization's guidelines.

Who needs high dollar value sheet:

01

Organizations involved in managing valuable assets, such as businesses, educational institutions, or government agencies, may require a high dollar value sheet.

02

Individuals or teams responsible for inventory management, asset tracking, or financial reporting may also need a high dollar value sheet.

03

High dollar value sheets are essential for insurance purposes, especially when insuring valuable assets against theft, damage, or loss.

Fill

da form 4986 pdf

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my high value sheet army in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign high value item sheet and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete army high dollar value online?

pdfFiller has made it simple to fill out and eSign army high dollar value. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the army high dollar value electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your army high dollar value in seconds.

What is da 4986?

DA 4986 is a Department of the Army form used to document and report certain information related to military personnel and operations.

Who is required to file da 4986?

Military personnel, including soldiers and their commanding officers, are typically required to file DA 4986 to ensure proper record keeping and compliance with regulations.

How to fill out da 4986?

To fill out DA 4986, users should enter the required personal and operational information in the designated fields, ensuring all entries are accurate and complete before submission.

What is the purpose of da 4986?

The purpose of DA 4986 is to facilitate the accurate tracking and reporting of military activities and personnel information for administrative and operational purposes.

What information must be reported on da 4986?

DA 4986 requires reporting information such as personnel identification details, operational status, mission data, and any relevant observations or notes pertinent to the form's intent.

Fill out your army high dollar value online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Army High Dollar Value is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.